Paper to Profits: Maximizing Thinkorswim’s Paper Trading for Success

Paper trading, also known as virtual trading or simulated trading, is a method of practicing trading strategies.

Paper trading, also known as virtual trading or simulated trading, is a method of practicing trading strategies.

One of the primary attractions of 0 DTE options trading is the potential for rapid profit accumulation.

Understanding how BITO operates and makes money requires a closer look at its underlying investment strategies.

In the competitive arena of online trading education, WarriorTrading.com and TastyLive.com stand out as prominent contenders.

Backtesting allows traders to simulate trades, measure performance metrics, and identify patterns or inefficiencies that can inform future trading decisions.

The first step in changing your money mindset is recognizing the limiting beliefs that hold you back.

Options trading offers a dynamic way to generate income. Join a community for guidance and start your financial empowerment journey.

I have been using Finviz.com for about a year now. What is Finviz?

Tastylive..com is a must-watch for anyone looking to master the art of options trading.

How BITO generates income to support its monthly dividend payments.

Tastylive distinguishes itself through its extensive library of educational materials.

So, you’ve stumbled upon Finviz in your quest for financial glory.

Today, transactions are executed with lightning speed through electronic systems.

Robinhood, the commission-free trading app that has democratized investing for millions.

Guest blogger explores discovering options trading for financial freedom, emphasizing the thrill of learning and its potential for increased financial independence.

The Morgan Stanley and ETRADE merger represents a transformative event in the wealth management industry.

Equip your kids with financial literacy essentials including introducing them to the concept of options.

With Dorian Trader member and guest blogger, Gordon Dew, consider this strategy that can generate profits in any market condition – up, down, or sideways.

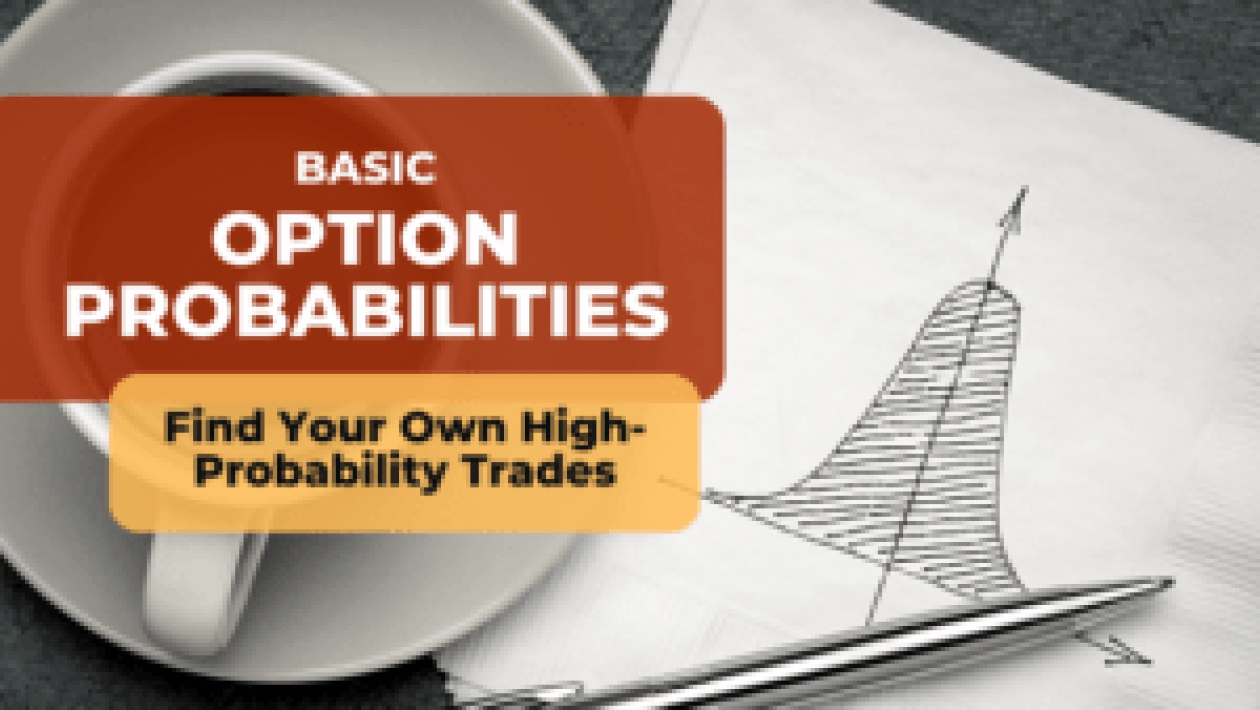

Doriantrader Basic Option Probabilities: Find Your Own High-Probability Trades There are many options trading strategies to learn and various methodologies touted by self-proclaimed options “experts.”

Doriantrader Get Started Trading Options At The Dorian Way, new traders who come to us for mentoring often fall into two categories. We help people

Doriantrader Three Things I Wish I Had Known Before Starting to Trade Options Despite what the title says, there are many more than three things

Doriantrader The Dorian Way Channel https://www.youtube.com/watch?v=vTg0L4268Do Enjoy regular content on The Dorian Way YouTube Channel. Check out educational videos as well as recorded live trading.

Doriantrader Options on Futures So, here’s an interesting question. What happens when you take a derivative of a derivative? It sounds like either something out

Doriantrader Strategic Betting With Vertical Options Oftentimes traders and investors get stuck where they have a position in the stock, or want to initiate one,

Doriantrader Selling Call-Spread Options on Gold Futures In options terminology, a call spread is a strategy in which an equal number of calls are purchased

Doriantrader Cash Settled Index Option Trading The financial market landscape offers a wide assortment of financial products and services. A good part of the products

Doriantrader How to Sell OTM Iron Condors on Natural Gas Futures If you’ve been trading options only on stocks, it’s time to branch out a

Doriantrader Trading Options on Commodity Futures While option trading is most commonly associated with stocks, commodity futures also have a robust derivative market. If you’re

At Dorian Trader, we help traders of all levels get started, improve and, ultimately, make more money with options.

Dorian Trader LLC 2700 Post Oak Blvd, 21 Floor Houston, Texas 77056

1. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.