Doriantrader

Basic Option Probabilities: Find Your Own High-Probability Trades

There are many options trading strategies to learn and various methodologies touted by self-proclaimed options “experts.” Understanding basic option probabilities is at the heart of many of them. At Dorian Trader, we primarily teach options selling. This is our preferred method, based largely on the probabilities of trades.

In this article, we provide a basic overview and example of Probability of Profit, Delta and Probability of Touch.

Probability of Profit (POP)

When you understand POP, you understand why, at Dorian Trader, we largely sell options.

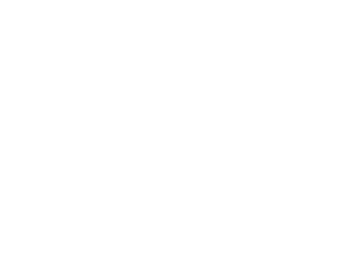

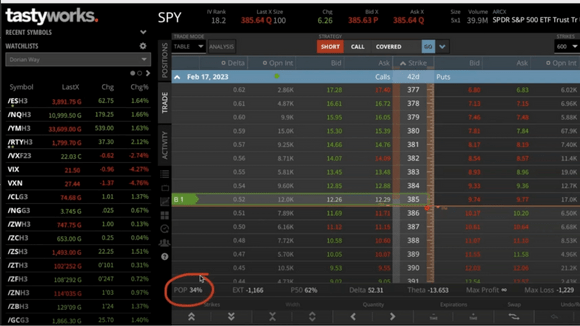

Take a very basic example – buying versus selling a call at the at-the-money (ATM) line.

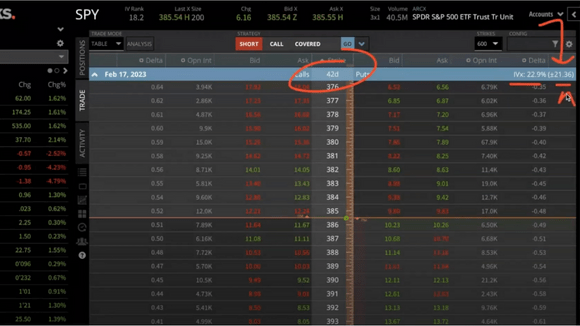

For this example, we demonstrate in the SPY with an expiration period of 42 days.

Theoretically, you have a 50/50 chance of winning whether you buy or sell ATM. In reality though, the probability of profit (POP) is skewed in favor of selling.

Buying ATM:

Selling ATM:

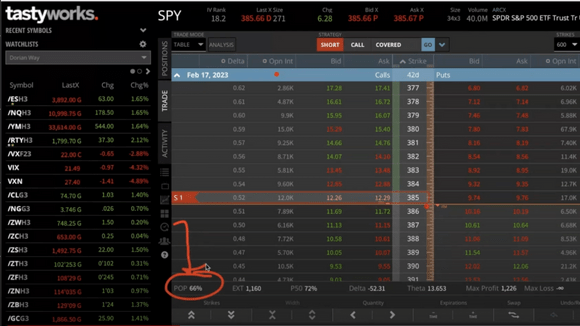

While this example is on the call side, the same holds true on the put side. Even when buying a call deep in the money at the mid-price, the POP still isn’t 50/50:

Important Points about POP

The POP factors in both the cost of the transaction. So while you can get close to 50% odds, the cost of the transaction can tip

the scales from 50% odds to slightly less.

The probability of profit is at expiration. In other words, your odds on any given day within the expiration can look bleak. But if you hold the position,

your odds are the POP.

Expected Move

Considering a trade at expiration is a key to being successful with options. Like POP, the expected move takes into account the entire period.

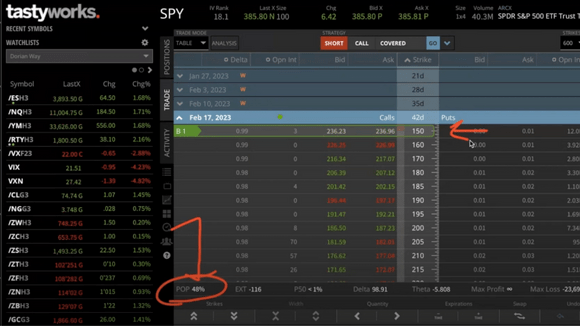

Take this same example; the expected move is +/- 21.43. This does not mean the price will stay in that range every day of the next 42 days. The price could swing 200 points or more. The expected move is, statistically-speaking, where the price range will land at expiration. In other words, your position may very well be “touched.”

Probability of Touch

The probability of touch is 2 x delta. Understanding the probability of touch can help traders manage expectations throughout the trades’s expiration period.

For instance, if you have a delta (or probability) of 50—so your position is ATM—you have a 100% chance of your position being “touched.”

Or, if you sell a position at the 15 delta, while you have an 85% chance of winning at expiration (assuming you hold it for that long), you have a 30% chance of being “touched” within the expiration period.

If you have a lower risk tolerance, trading at the 30 delta or lower will cause you anxiety because the odds are likely (60%) that your position will go in the money, at least for a time.

Practical Takeaways

While you can win within the expiration period, understanding that the implied volatility, POP and delta are all based on where the numbers fall at expiration, should provide two takeaways as it relates to basic option probabilities.

First, it is essential to watch whatever positions you put on. For example, if you know that the odds are less than 50/50 that you will win at expiration, you will want to take any winnings within the expiration period or settle for less than 50/50 odds.

- [Resource]: The Dorian Way School

- [Book Recommendation]: Fooled by Randomness: The Hidden Role of Chance in Life & in the Markets

Secondly, now that you know you may be “touched” within the expiration period, you may be more inclined to hold a position for longer knowing that ultimately the odds are in your favor (if, say, the POP is 90%). You may be less inclined to act emotionally or to adjust your position unnecessarily.

The more you know about the probabilities of a position, the more you can use them to make money with options.

The Dorian Way provides support for traders of all levels, regardless of your understanding of basic option probabilities. See how we can help you based on your experience and goals by visiting our Learn More page.

Check out the corresponding video on our YouTube channel. While there, please like and subscribe. Thanks!

Danielle Nelson

January 15, 2023