DORIAN TRADER

The Rise of Weekly Options: Why Traders Are Shifting From Monthlies to Shorter Cycles

Weekly options have become one of the most important shifts in the options trading landscape. What used to be a niche tool reserved for active traders is now a mainstream approach used by beginners, intermediates and professionals. In 2025 the trend is clear: weekly options are expanding faster than monthlies, and their popularity shows no sign of slowing down.

This change is not accidental. It’s the result of higher market volatility, more frequent catalysts, better platform access and a growing desire among traders to generate smaller, more consistent returns. Weekly options allow traders to react quickly, manage risk efficiently and capture opportunities that simply are not available in 30-day cycles.

If you want to take advantage of this new market environment, understanding the mechanics and discipline behind weekly options is essential.

What Exactly Are Weekly Options?

Weekly options are contracts that expire every week, rather than once per month. Over the years, exchanges expanded availability so that many popular tickers now offer expirations four to five days per week. This gives traders:

![]() More flexibility

More flexibility

![]() Faster income cycles

Faster income cycles![]() Better alignment with economic data, earnings and market events

Better alignment with economic data, earnings and market events

![]() Faster resolution of risk

Faster resolution of risk![]() Smaller capital requirements

Smaller capital requirements

Instead of waiting a full month for a strategy to play out, traders can now execute,and learn, much faster.

Why Weekly Options Are Surging in this Year

Several market forces are contributing to the shift toward weekly expirations:

1. More volatility, more opportunity

Shorter cycles allow traders to navigate volatility spikes with precision, something monthlies struggle to handle.

2. More frequent catalysts

Inflation releases, earnings, rate decisions and geopolitical events now move markets weekly.

3. Better tools and platforms

Traders have more access to analytics, flow data and risk models, making shorter-term trading more manageable.

4. Faster feedback loops

New traders prefer faster learning and more frequent cycles to build skill quicker.

The Advantages of Weekly Options for Active Traders

Weekly options offer several unique advantages when used with structure:

| Faster income potential | Defined-risk strategies like credit spreads or iron condors allow traders to generate returns weekly instead of monthly. |

| Stronger control over risk | Smaller time windows help avoid overnight or long-term market surprises. |

| More precise alignment with events | Traders can position around catalysts,earning an edge around specific days. |

| Lower duration = lower exposure | Being in the market for fewer days reduces the chance of unexpected volatility. |

The Risks Most Traders Overlook

Weekly options are powerful, but they magnify certain risks:

- Gamma moves faster

- Time decay accelerates

- A small mistake can become a large loss quickly

- Emotional discipline becomes non-negotiable

- Overtrading is a real threat without rules

Many traders underestimate these factors, which is why education and structured mentorship are critical

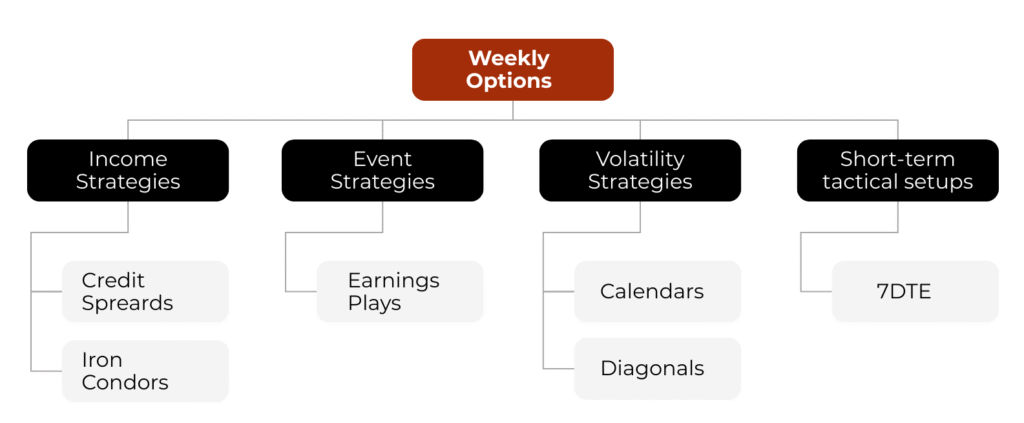

Weekly Options Strategies That Work

These strategies thrive under shorter cycles:

1. Credit Spreads (bull put / bear call)

High probability, defined risk and ideal for weekly conditions.

2. Iron Condors

Take advantage of fast IV crush during quiet weeks.

3. Earnings-aligned trades

Use short cycles to capture volatility drops after earnings events.

4. Calendars and diagonals

Great for more advanced traders managing volatility differences.

5. Structured 7DTE trading systems

Precise timing, often used by experienced traders to generate consistent returns.

You can see examples of how these strategies perform in real time in the following videos from Dorian Trader’s channel:

1. How I Won for 18 Months Straight

This video is one of the best demonstrations of how weekly options can deliver consistent results when paired with discipline and a structured process.

2. A Blueprint for 1% to 2% Weekly Returns: Weekly Options

This video breaks down the exact timing windows and practical approach behind consistent weekly returns.

How Experienced Traders Use Weekly Options Differently

Professionals use weekly options with a clear framework:

- Strict position sizing

- Reduced trade frequency

- Focus on quality setups, not quantity

- Defined entry/exit criteria

- Emotional neutrality

- Focus on probabilities, not predictions

The difference between amateurs and professionals is rarely the strategy, it’s the discipline behind it.

Why You Should Not Trade Weekly Options Alone

Shorter cycles move fast. They reward structure and punish improvisation.

Many traders:

- Chase activity

- Trade too many tickers

- Follow random online advice

- Do not understand volatility

- Skip backtesting

- Use position sizes that are too large

This is where a strong trading community becomes a major advantage.

Why A Trading Club Is the Best Place to Learn Weekly Options

Dorian Trader’s Trading Club exists for one purpose: to teach traders how to navigate markets with consistency and discipline.

Inside The Trading Club you get:

- Experienced traders who trade weekly options every day

- Strategy breakdowns that match current market conditions

- Supportive accountability

- Live trade reviews

- A structured approach to probability, risk and timing

- Tools, frameworks and feedback you can apply immediately

If you want to take weekly options seriously in 2025, you shouldn’t go at it alone.

Join the Club and learn alongside traders who have mastered the craft.

Ready to Begin?

Join the Dorian Trader Club

Weekly Options Are Here to Stay

The rise of weekly options is transforming the options market. As 2025 unfolds, traders who understand short-term cycles and apply disciplined systems will have a clear advantage.

Whether you’re brand new to options or looking to refine your approach, weekly options offer incredible potential, if you know how to use them.

If you want to trade weeklies with confidence, structure and support, our Trading Club is the next step.

Join a free session, meet traders like you, and see how Dorian Trader turns curiosity into confidence.