DORIAN TRADER

CaLENDAR SPREAD STRATEGY FOR MARKET VOLATILITY

The calendar spread strategy is one of the most efficient ways to position around these events. It allows you to express a view on timing and volatility without overpaying for premium or taking on excessive risk.

When the market is gearing up for a major event—like an earnings release, Federal Reserve announcement, or inflation report—short-term option premiums often spike. Traders expecting a reaction but uncertain about direction can use this temporary increase in implied volatility (IV) to their advantage.

What Is a Calendar Spread?

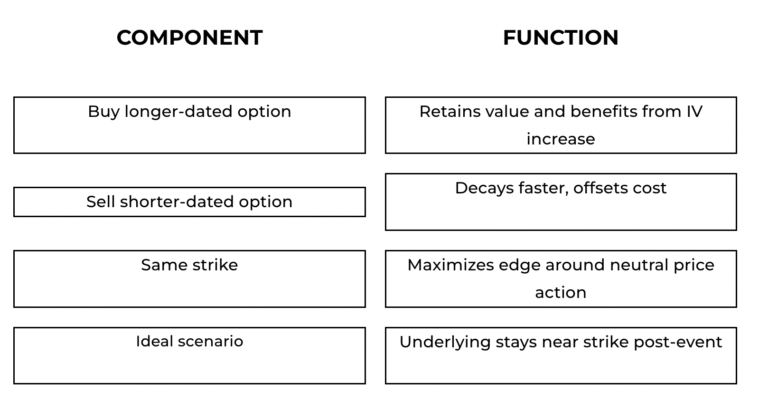

A calendar spread, also known as a time spread, involves two options at the same strike price but with different expiration dates. The basic structure looks like this:

![]() Buy a longer-dated option

Buy a longer-dated option

![]() Sell a shorter-dated option

Sell a shorter-dated option

![]() Both at the same strike

Both at the same strike

This setup takes advantage of the faster time decay in the short-term option while maintaining exposure through the longer-dated contract. Ideally, the underlying stays close to the strike, allowing the short leg to lose value quickly while the long leg retains premium or even increases in value if longer-dated IV rises.

Why Calendar Spreads Work in Volatile Markets

Before major announcements, short-term IV often rises as traders position for potential movement. This drives up the price of front-month options, while longer-dated options tend to rise less or stay stable. That difference creates an opportunity.

By selling the expensive front-month option and buying the more reasonably priced back-month option, you can build a low-cost position that benefits if:

The underlying remains near the strike

Short-term volatility collapses after the event

The underlying remains near the strike

This is particularly useful when you expect volatility but don’t want to commit to a full directional bet.

Example: SPY Calendar Spread Before a Fed Meeting

Imagine SPY is trading around $500 just ahead of a Federal Reserve decision.

Trade setup:

- Buy a SPY 500 call expiring in 30 days

- Sell a SPY 500 call expiring in 7 days

If SPY stays near $500 after the announcement, the short call decays quickly due to time and volatility drop. Meanwhile, the longer-dated call retains its value. The result is a potential profit from the time decay difference and post-event volatility reset.

When to Use Calendar Spreads

Calendar spreads are best suited for:

![]() Earnings announcements

Earnings announcements

![]() CPI or jobs reports

CPI or jobs reports

![]() Federal Reserve meetings

Federal Reserve meetings

![]() Market environments where front-month IV is inflated

Market environments where front-month IV is inflated

They’re especially effective when you expect price stabilization near a key level after an initial move. They can also help reduce cost compared to buying outright long options, which can suffer from theta decay.

Calendar Spread Snapshot

Risks to Watch

Like any options strategy, calendar spreads have trade-offs. The biggest risks include:

![]() Directional move: If price moves sharply away from the strike, both legs may lose value

Directional move: If price moves sharply away from the strike, both legs may lose value![]() Volatility crush: If IV drops across both expirations, especially after earnings, the position may decline

Volatility crush: If IV drops across both expirations, especially after earnings, the position may decline![]() Gamma exposure: As the short option nears expiration, price swings can affect the trade more aggressively

Gamma exposure: As the short option nears expiration, price swings can affect the trade more aggressively

To manage these risks, we often size conservatively and close early if the trade reaches 50 to 75 percent of its max profit.

How We Use Calendar Spreads at Dorian Trader

At Dorian Trader, we focus on strategies like calendar spreads to manage volatility around earnings and macro events. Inside the Trading Club, we discuss how to structure these trades, select strikes, and analyze volatility setups so members can refine their own trading plans.

Want to see how we plan, manage, and exit trades like these in real time?

Join the Dorian Trader Trading Club for weekly trade ideas, real-time coaching, and actionable strategies built for volatile markets.