DORIAN TRADER

What Is Delta in Options Trading? A Simple Guide for Beginners

In options trading, Delta (∆) is one of the most important Greeks every trader must understand. Whether you’re selling options for income or buying options for directional plays, Delta helps you estimate probability, risk, and how your option’s price will react to market movement.

In this article, we’ll break down what Delta is, how it relates to Probability of Touch, Probability of Winning at Expiration, and what Delta truly means in real trading.

What Is Delta (∆)?

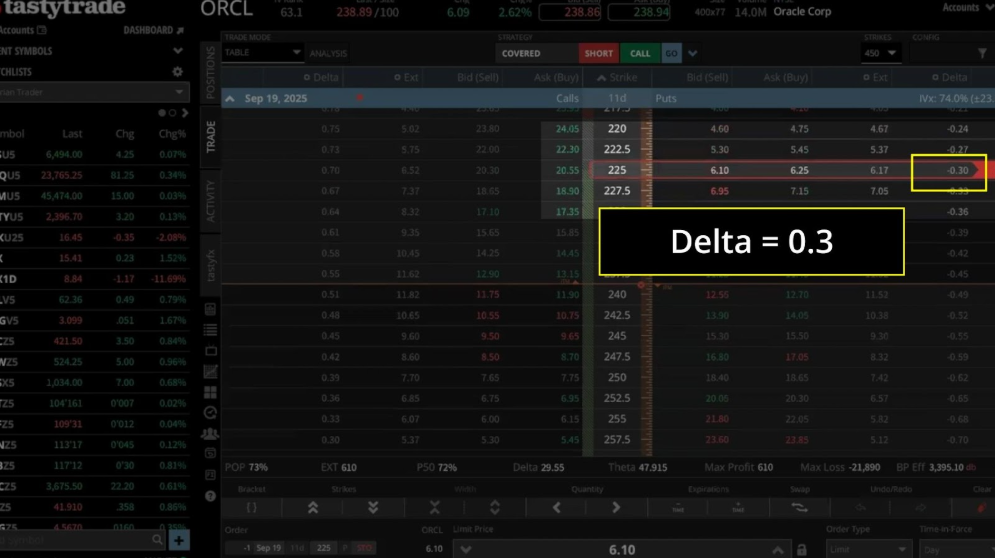

Delta measures how much the price of an option changes when the underlying stock moves by $1.

- If Delta = 0.30, the option price is expected to move $0.30 for every $1 move in the stock.

- Calls have positive Delta

- Puts have negative Delta

But Delta is more than just a sensitivity number, it also represents probability.

Delta as Probability

Many traders use Delta as a probability estimate:

- A 30 Delta (0.30) option ≈ 30% chance the option will finish in-the-money (ITM) at expiration.

- A 10 Delta (0.10) option ≈ 10% chance ITM

- A 50 Delta (0.50) option ≈ 50% chance ITM

This is why Delta is extremely useful for option sellers and risk managers.

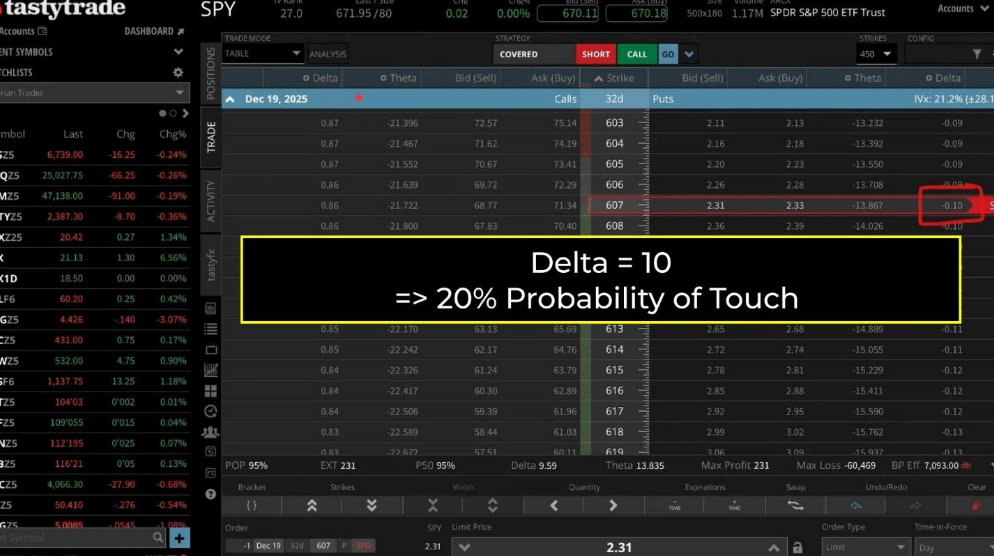

Delta and Probability of Touch (POT)

Probability of Touch estimates the chance that the stock price will touch your strike price at ANY time before expiration.

A simple rule used by professionals:

Probability of Touch ≈ 2 × Delta

Ví dụ:

- A 30-Delta call has about a 60% chance the stock will touch that strike sometime before expiration.

- A 10-Delta put has about a 20% chance of being touched.

This explains why selling far-out-of-the-money options still requires proper adjustments, because the strike might be touched, even if it doesn’t finish ITM.

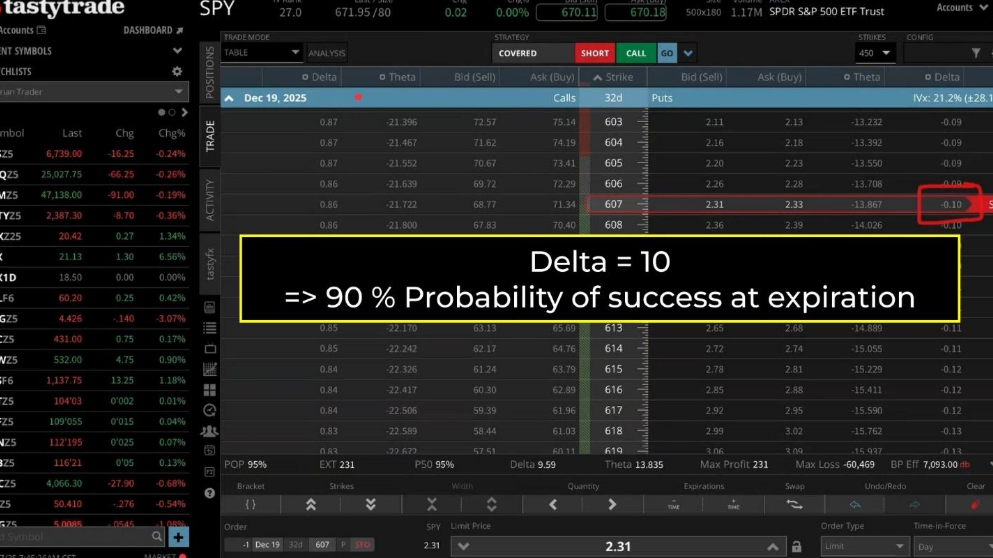

Delta and Probability of Winning at Expiration (POW)

Probability of Winning (out-of-the-money at expiration) is the opposite of finishing ITM.

For sellers:

- POW = 1 – Delta

So:

- Selling a 30-Delta call → about 70% probability of winning

- Selling a 15-Delta put → about 85% probability of winning

- Selling a 5-Delta option → about 95% probability of winning

The Meaning of Delta in Real Trading

Delta helps traders answer three critical questions:

How likely is the stock to reach or exceed my strike?

Lower Delta = lower probability of finishing ITM.

How sensitive is my option’s value to price movement?

A 50-Delta option behaves almost like owning 50 shares.

How directional is my position?

High Delta = more directional risk

Low Delta = more probability-based, income-focused

Additional implications of Delta:

- Delta increases as options get closer to ITM.

- Delta decays as options go further OTM.

- Delta accelerates with volatility changes (related to Gamma).

- Selling high Delta = higher reward but higher risk

- Selling low Delta = safer but lower premium

Delta is not just a Greek, it’s a roadmap.

Understanding Delta helps traders:

- Estimate probability of touch

- Estimate probability of winning at expiration

- Evaluate risk directionality

- Make smarter decisions when selling or adjusting options

- Manage positions like a professional instead of trading emotionally

Whether you’re a beginner or advanced trader, mastering Delta will improve the way you structure trades, control risk, and grow your account.

Unlock your potential as an options trader with Dorian Trader, where you’ll learn how to master key concepts and the real probabilities behind every trade through expert mentorship and clear, practical guidance!

Join a free session, meet traders like you, and see how Dorian Trader turns curiosity into confidence.