DORIAN TRADER

The Myth of ‘Easy Money’ in Options Trading

Why the “Easy Money” Narrative Is So Popular

Every year, new traders enter the market with the same expectation: fast profits, quick wins, and a shortcut to financial freedom. Social media is full of screenshots, bold claims, and overnight success stories that suggest options trading is a simple way to generate income. The message is clear and repeated constantly: options trading is easy money. The reality, however, is very different. The belief that options trading is simple and fast is one of the main reasons most traders fail. This myth creates the wrong mindset, encourages poor habits, and leads to decisions that damage both accounts and confidence over time.

The idea of easy money usually comes from three main sources. First, social media highlights only the best moments. You see winning trades, but you never see the losses, the drawdowns, or the months of preparation behind those results. Second, marketing plays a big role. Many platforms and influencers promote fast success because it attracts attention and sells. “Turn $500 into $5,000” is more appealing than “build a process over two years.” Third, there is human nature. We all want results with less effort. That is normal, but in trading, it becomes dangerous. Options are powerful tools that can produce strong returns, but they can also create fast losses. Treating them as easy money ignores that risk.

What Happens When Traders Chase Fast Profits

When traders focus on quick profits, certain patterns almost always appear. They begin to trade more frequently, take setups that do not meet their rules, and react emotionally to short-term price movements. This behavior is not random. It is driven by pressure. Pressure to win, pressure to prove something, and pressure to make trading work quickly. Over time, this leads to predictable mistakes such as:

- Overtrading and forcing setups that are not there

- Increasing position size too quickly after a win

- Abandoning a strategy after a small losing streak

- Jumping between systems without giving any process time to work

- Making decisions based on emotion rather than rules

The problem is that markets do not reward impatience. They reward discipline. Traders who survive and grow over time are not the ones chasing the next big win. They are the ones focused on execution, risk control, and consistency.

Why Consistency Beats Excitement in Options Trading

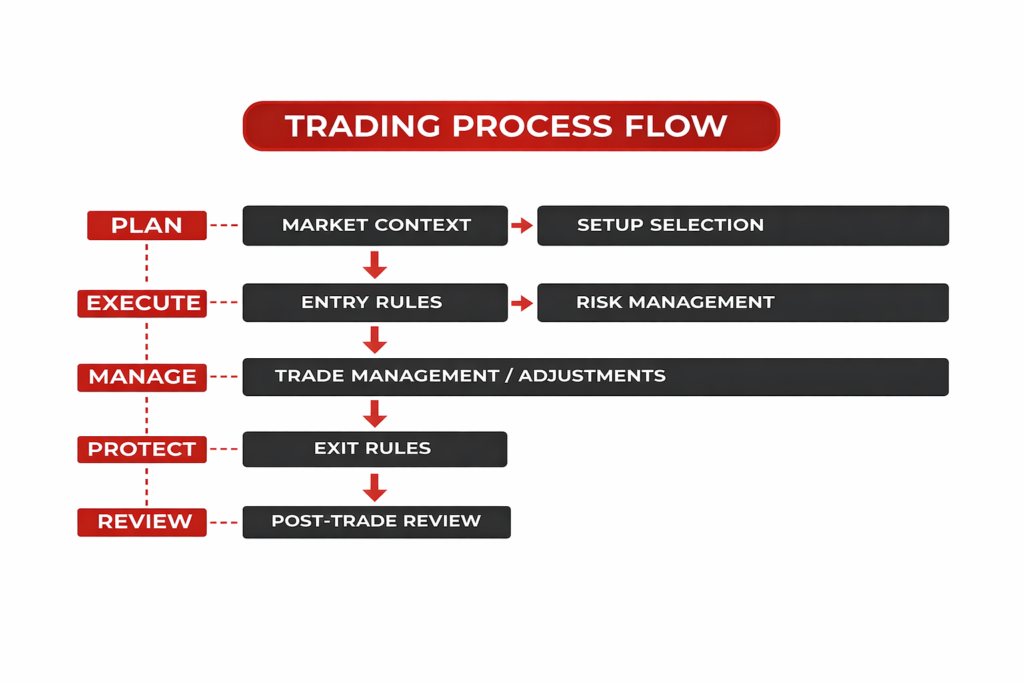

There is nothing exciting about consistency. It is not flashy and it does not go viral, but it is what works. Consistency comes from structure. Structure means having a clear process for how you trade, how you select setups, how you enter, how you manage risk, how you adjust positions, and how you exit. It also means knowing when not to trade. Staying out when conditions do not fit your rules is just as important as taking a position. This approach is the opposite of easy money. It requires patience, repetition, and control, but it creates stability over time.

If this sounds familiar, you’re not alone. Many traders fall into this cycle without even realizing it. In this video, Dorian breaks down why chasing fast profits usually leads to fast losses and how a more structured, “boring” approach is often the one that actually works. It’s a clear example of how discipline beats excitement in real trading.

Discipline Is the Real Competitive Advantage

Many traders spend months searching for the perfect strategy, believing that the right setup will finally make everything click. Very few spend time building discipline. Discipline is doing the same thing every day, even when it is boring, even after a losing trade, and even after a winning streak. It is following your rules when you feel confident and when you feel frustrated. It is managing risk when you are tempted to push size. This is where most traders struggle, not because they are not capable, but because discipline is uncomfortable. Easy money promises comfort. Real trading demands control.

The Hidden Cost of Believing in “Easy Money”

Believing in easy money has real consequences. Accounts get overleveraged, risk gets ignored, and losses get bigger. Over time, traders start doubting themselves. They blame the market, the strategy, or the platform. They move on to something new, hoping it will be different this time. The cycle repeats. This is not a knowledge problem. It is a mindset problem. Without structure and discipline, even the best strategy will fail.

How Serious Traders Approach Options Differently

Serious traders approach options with a completely different mindset. They focus on process before profit, knowing that results are a byproduct of correct execution. They build repeatable routines and measure performance over months, not days. They care more about drawdown than upside and understand that protecting capital is the foundation of long-term success. In practice, this means they prioritize:

![]() Clear entry and exit rules that are followed consistently

Clear entry and exit rules that are followed consistently

![]() Defined risk per trade, regardless of confidence level

Defined risk per trade, regardless of confidence level

![]() Position sizing based on account protection, not emotion

Position sizing based on account protection, not emotion

![]() Reviewing trades to improve execution, not to chase perfection

Reviewing trades to improve execution, not to chase perfection

![]() Staying selective and waiting for high-quality setups

Staying selective and waiting for high-quality setups

Options are tools, not lottery tickets. Trading is treated as a skill, not a gamble. This approach is slower and quieter, but it is sustainable.

Why Community and Standards Matter

One of the most underestimated parts of trading is community. Trading in isolation makes it easy to break rules and justify bad decisions. When no one is watching, standards drop. Being part of a serious trading community changes that. You see how others manage risk, how they think, and how they approach the market. You stay accountable and exposed to different perspectives. Experienced traders value community not for tips, but for standards. Standards shape behavior, and behavior drives results.

There Is No Shortcut in Options Trading

There is no shortcut in options trading. There is no system that removes risk and no strategy that works every time. There is no method that guarantees income. What exists is a path. A path built on education, structure, discipline, and patience. It is not easy, but it is real. And real always beats easy in the long run.

Choose Real Over Easy

The myth of easy money is attractive, but it is also destructive. It pulls traders away from the habits that actually create progress. If you want to trade options seriously, let go of the shortcut mindset. Focus on building a process, managing risk, and executing with consistency. That is where real growth happens.

If you are looking to learn in a structured environment and connect with traders who take their process seriously, the Trading Club offers education, strategies, and a community built around discipline and long-term thinking. Not easy. Not fast. But real.

Ready to Begin?

Join the Dorian Trader Club

You can review the complete course catalog here:

All programs at thedorianway.thinkific.com